In order to fully understand the ground breaking opportunity Karatbars provides please look at the following facts when comparing Karatbars Gold to other gold sellers:

Most customers when looking to BUY Gold, ANY

gold, usually deal with RETAIL. All they typically see or know

to compare is price.

Some retail companies may give them a special discount for a purchase.

But it's still retail without other financial rewards. When the deal

is done, IT'S ALL DONE.

And

without knowing all the features and benefits included in KARATBARS, they may jump

to conclusions. They don't know. For many, it may not be

that important to them. But for those who want the facts will get

them.

WHY? Because they have NEVER been exposed

to anything like this before. KARATBARS is a Category-Creator.

NO one is doing what Karatbars is doing globally.

So LOGICALLY, without some explanation, someone may ASSUME that

Karatbars is in some kind of "BAKE SALE" and simply include it with other "gold" companies.

It's LOGICAL...But INVALID.

So, why

should one NOT look at only price to make an accurate, informed

complete comparison?

Karatbars has the lowest price for

their gold category. Compare BMW to BMW, not Ford to

BMW. Google: kinebar grade 1 gram gold .

But

before we get into all the reasons why owning a 1-gram Karatbar makes far

more sense in this economy than owning a 1-ounce bar-even though the

same amount of gold may be lower in

price-lets compare prices of several 1-gram bars:

Prices

For KARATBARS | Apples to Apples Prices

For KARATBARS | Apples to Apples

When you're thinking

about the price of KARATBARS

gold bullion and you somehow come to the conclusion that the

prices are too high, you haven't compared apples to apples.

It's like this: A Chevy Cavalier is a car just like a

Corvette is a car. Bottom line is they're both cars. But

the fact is one costs more, is worth more, and retains its value

better. Gold coins, bars, and ingots are all gold, but with varying

purity and weights.

Comparing Prices

With KARATBARS Gold Bullion

The first

thing in comparing prices of ANY commodity is understanding that you must

do an apples-to-apples comparison. For example, if you are going to buy a pint of

milk you must compare the price with other single pints of milk.

What you DON'T do is find the best price

for a GALLON of milk (which, for the sake of discussion, lets

say is $4) and then divide $4 by 8 pints (which is 50

cents per pint), and then compare that price to buying a single

pint. We all understand what it means to buy in bulk. As with any product, there is what is commonly called volume

discounts. The reason bulk prices are less

per ounce is very simple: there is more labor cost to produce several units verses one unit, but the flexibility of use

benefits are significant with 1-gram gold over larger

weights.

To get an accurate

price comparison (not taking into consideration the MANY

benefits that come with owning a flexible transaction-friendly

1-gram Karatbar), you cannot take the spot price for an ounce of gold and divide it by 31.1. (There are

roughly 31.1 grams per troy ounce of gold.) And you

cannot take a gram price and multiply it by 31.1. You must price Karatbars gold

bullion by the gram against other

similar-quality gold that's sold by the gram to make

an accurate comparison.

Is The Price of KARATBARS Gold Bullion In Line

With What's Out There?

With gold and silver, you pay more

for smaller weights regardless of your source. Just like you pay

more for 1 can of soda or beer than you would pay for a case of 24 cans.

The more you buy, the better price you get.

If you want to be accurate and compare apples to

apples, ask your broker what his/her price is for a 999.9-grade

1-gram gold

bullion produced by an LBMA-certified refinery? No one

can touch Karatbars price! Karatbars has consistently

maintained a 2-4% better price.

Even if a broker could match or beat Karatbars

prices, will they give you free gold for referring others?!? I

think not. And all require you to buy many

1-gram bars even if you only want to buy one and although they

may advertise they can deliver, they are often out of stock or cannot

actually deliver gold in one gram weights.

KB's

program is NOT for traders. It is for savers and many ask "what does

it cost"? This is a poverty mentality because a wealthy mentality

asks "what is it

worth"!

As of mid-February, 2012, when $1 (USD) exchanges for 1.32 Euros, the price of a 1-gram Karatbar was approximately $78. It's not what it costs; it's what the market says it's worth. Cost and worth are two different things, much like an acre of land on the U.S west coast inMalibu is worth more than an acre of land in Iowa. Karatbars is "prime real estate": It costs less than comparable 1-gram gold bullion bars of this quality; it resells for more; and it holds its value out of the vault.

POINT #1

KARATBARS are private issue (produced by a private refinery and mint and exclusive to Karatbars) 999.9% 24-carat Gold Bullion... and are not subject to seizure under the current International Bullion Laws and U.S. Law.

Gold coins that have minted and issued from any government can be recalled to issuer (the government). All gold from Karatbars is privately issued and CANNOT be confiscated by any so-called authority.

Karatbars gold is Private Issue bullion, 999.9% Fine Gold, each Karatbar weighs in at 1.01 grams

Transactions are completed offshore, gold is vaulted offshore, and all transaction records belong to Karatbars

Karatbars carry the LBMA certification from the Atasay Refinery which lends them to be "Good for Settlement of Debt "http://lbma.org.uk/pages/index.cfm

You, as an Affiliate, are responsible to report any earnings to the local authorities (country, state, etc), (Terms & Conditions). Karatbars DOES NOT REPORT to any Affiliate earning to any government body.

-

Karatbars is an Offshore E-Commerce company with an Affiliate marketing program.

-

Karatbars does not apply to the FTC (NOT an MLM) or the BBB (Domestic Rating Agency), all are which come under U.S. government jurisdiction, or any other jurisdiction not held under the International Bullion Laws.

-

Karatbars does not apply to the Securities Exchange Commission (SEC), since gold is not considered a financial instrument. (paper)

-

Karatbars does not give legal, tax, or investment advice and all Affiliates should not either.

Karatbars falls under the International Bullion Laws set forth by the World Trade Organization under the Harmonious Tax Code.

ANY and ALL gold purchases and gold coin purchases that are done in USA are RECORDED. The U.S. government knows exactly who has what. Most coins are PURE gold on the ALLOY Standard - 91.9% - because 24-carat is too soft. You do not actually OWN any government-issued coins; you are merely THE BEARER of the coins. Governments in financial duress can "recall" gold coins and only pay bearer FACE VALUE only. Ask yourself this: "Where do you think the U.S. government is going get the gold to restock THEIR shelves?"

Karatbars ingots weigh in at 1.01 grams, above the legal limit if a country tries to exercise a VAT Tax on 1-gram bars. We have a niche market of transaction-friendly weights which make it a viable form of payment and exchange, under ALL economic circumstances, in ALL countries.

Karatbars accounts are private and SECURE, more so than the FDIC, CDIC, or ANY gold sales in the USA or Canada.

100% of all funds you deposit into your Karatbars account are used to buy gold bullion. There are no extra fees.

Karatbars does not report any Customer transactions under $10,000 to any government agency in any country. And Karatbars does NOT ask for a Social Security Number (SSN) or Social Insurance Number (SIN). Your identity is kept confidential for your account as long as you are NOT charges and convicted with money-laundering, involved in drug trafficking, or other international crimes under the U.S. Patriot Act.

All transactions are recorded by username and account number. When verified by German authority auditors, you only need to verify your account number, deposit, and whether the deposit was transferred into physical gold and transferred to the vault or shipped to you, the Customer. Germany is possibly the toughest country in the European environment in which to do business.

Karatbars International is an offshore (Germany) e-commerce company with an optional Affiliate Marketing program. Karatbars International is NOT governed by the USA. It is on the same level of trade existence that the U.S. government uses when dealing with any other country.

We merely have our own personal Karatbars accounts, and we can refer others to get their own private Karatbars account. We do not sell financial paper instruments, nor does Karatbars. Affiliates do not sell gold; Karatbars does, OFFSHORE. Some licensed gold resellers do resell Karatbars. Only Karatbars account holders can make referrals, and we are rewarded for referring others. New Account holders can get a Karatbars account only by being referred by a Karatbars Affiliate account holder.

Although we resemble a leveraged type of marketing structure, we are NOT considered MLM in any country. Karatbars is an e-commerce Affiliate business model. Our Compensation Plan pays out only when paper money is exchanged into gold money. That's it. There are NO enrollment fees, etc.

POINT #2

Karatbars in 1-gram weights have many more benefits than gold in 1-ounce weights. They are both gold, but it's like comparing an apple to a rock! You CANNOT compare by price. The features and benefits are simply too far apart.

USE GOLD TO BUY GOODS AND SERVICES, NOT AS AN INVESTMENT!

The majority of those who look at gold will ALWAYS start by comparing price, thinking the only reason to own gold would be as an investment. It is not. They do not understand that one ounce of gold is one asset class, and one gram of gold is a totally different asset class, even though they are both gold. Even though they are both gold, the benefits of owning a gram of gold compared to owning an ounce of gold are significant. Karatbars is about owning 1-gram gold bullion ingots that you could use as a form of exchange, much like you use paper money and credit/debit cards. It would be much more difficult doing that with larger weights of gold and certainly not with a 1-ounce gold coin. Following are things to consider when buying gold:

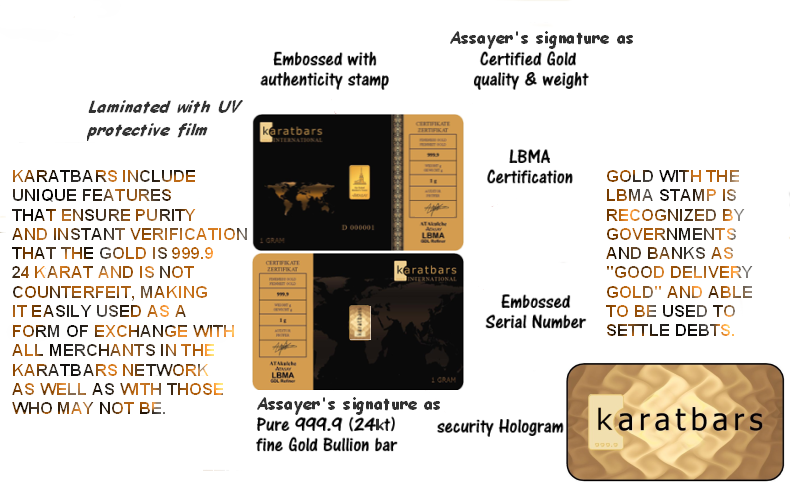

IS IT REAL? KARATBARS CANNOT BE COUNTERFEITED

Gold can and is being counterfeited. In order to know the gold is not fake or counterfeit, one must sell that gold to a gold dealer who has the tools to confirm it is pure. With Karatbars, ANY merchant who is taught what to look for with the naked eye can quickly and easily determine that every Karatbars is not a fake because it has:

-

The stamp of the London Bullion Market Association (LBMA) Atasay Refinery on the gold.

-

The signature of the Atasay Refinery's Assayer on the card.

-

An embossed serial number that is unique to that particular Karatbar.

-

The Refinery's unique hologram covering the entire back of the gold.

You want to own 1-gram Karatbars so that your gold does not need to be sold and converted back to paper money in order to get some future use out of them.

BUY-BACK PRICE

Withal weights of gold there is a buy-back price that's less than the sell price. With Karatbars there are MANY more options available than simply selling them back.

-

Use them to buy goods and services from the many Merchants who accept them as payment.

-

Post them in the Karatbars Member Marketplace at or near the Karatbars daily posted retail price.

-

List them in any of the many Karatbars Affiliate chat rooms to sell at or near the current retail price.

-

Sell back to Karatbars at a higher price than you would get from any gold dealer.

Only Karatbars allows one to find a way to get at or near the current day's retail value when ready to dispose of some.

NO NEED TO USE MORE THAN IS NECESSARY

If you own an ounce of gold, and need only a few hundred dollars, you will need to sell the whole ounce. If you have high inflation, you will want to leave as much as possible in gold. The inconvenience of finding a dealer willing to give you a fair price without having to stand in line etc., is something to consider as well. Karatbars (1-grams) eliminate the need to convert to cash or use more than is required at that time. You cannot chip off a piece from an ounce and expect anyone to give you just that amount in paper cash or goods and services.

THE MASSES CANNOT AFFORD TO BUY IN LARGE AMOUNTS

Karatbars bring gold to the masses. Almost everyone can afford to buy $65 at a time.

EARN FREE GOLD

Anyone, without ANY fees or costs, is able to introduce others to Karatbars and earn a commission. Yes, you can buy 100 grams of gold or an ounce if you choose. But why not, with very little effort, introduce others and have your gold bought with commissions earned?

POINT #3

Karatbars Gold has ALL the bells and whistles on it in its standard feature.

Produced by an LBMA-certified "good delivery" refinery. See http://LBMA.org.uk (Click on "Good Delivery tab / Gold List. Scroll down to Turkey. Click "Atasay..."), Karatbars are good for "settlement of debt" worldwide. Do not take the LBMA-certification lightly: It takes 3 years of zero issues for a refinery to get LBMA-certified. Our Karatbars cannot be counterfeited, and are verifiable by obvious and instant inspection.

Free storage abroad, in various geographic locations.

Low-cost shipping (about $20 for 40 grams) if you want your Karatbars delivered to you. Or you can have them moved to your own vault for an additional fee of approximately 2/10ths of a Euro per gram. Our company subsidizes the portion of the shipping cost that ensures the shipment reaches the Customer's designated destination.

One of the insurance is through SecurLog, as they record on video every single packaging for delivery and the actual card numbers, etc. sealed. And SecurLog has their own private insurance company. SecurLog has their own on-site Insurance. They are recognized by the World Gold Council, one of the largest in the gold industry. Once your Karatbars leave the company's hands, they are double-insured by both Karatbars and SecurLog. They are shipped via FedEx. Large deliveries are done by G4S, the largest global armored delivery company in the world.

The extremely high affiliate marketing internal payout (14.5% on the 100 gram Purchase Plans) allows Karatbars International to prepare for infrastructure labor and expansion. On one-time purchases, payout is 5.5%.

We have "Green Gold: Karatbars Green Technology Extraction Process uses NO mercury or cyanide. This makes them a serious TACTICAL PLAYER for gold production globally.

We are recommended by Bund de Sparer, a German independent consumer watchdog organization:

http://www.bds-deutschland.de/a/index.php/ist-gold-ausverkauft-mainmenu-370

Karatbars are stored in vaults, not in circulation or around circulation like a savings deposit vault of a regular bank. They are NOT held as collateral for something else like a prime funding venture or anything like that. If for some reason you cannot fully trust an offshore account then get your Karatbars delivered directly as a one-time purchase, right now.

Gold deposits are stored in large bars until ready to be minted into card denominations of your choice (0.5 gram, 1 gm, 2.5 gm, and 5 gm ingot cards. Until Karatbars has expanded to every country we can possibly in, we only offer 1-gram ingot cards.

Understand: To exchange into gold is one thing; to exchange out of gold is another. Karatbars is the simple, no-nonsense, worldwide solution to a full-presence answer to both types of exchanges. Karatbars offers a multi-faceted EXIT strategy unlike any other gold source.

Karatbars International will buy back your Karatbars with the guaranteed best buy-back price.

You can sell to other Karatbars Customers or Affiliates. (I sold 19 grams for $1290, that day's sell price, for a Customer who wanted part of his 100 grams sold, and I did it all in 1 day.) Use Karatbars to buy goods and services within the Acceptance Points Network(merchants). Soon, we will be able to exchange fractions of a gram online, not using the cards.

Other major financial institutions see us a reliable financial partner; for example, The Vatican bought and branded 100 kilograms of our gold and branded it with our Karatbars. NO ONE can doubt that the Vatican is a major financial giant worldwide. The Vatican doesn't get involved with hokey companies at all, Period.

We have made many presentations and expect to produce more Affinity Cards like the Pope cards. Football Teams, Hip-Hop artists, several churches, an Airline, and more are considering a private labeled Karatbar for themselves. We are just getting started.

Remember: EARNING FREE GOLD is better than buying it at ANY discount.

A few more reasons why owning Gold is such a good idea (Click on the title to expand):

I. HEDGE AGAINST INFLATION

Gold is renowned as a hedge against inflation. The most consistent factor determining the price of gold has been inflation - as inflation goes up, the price of gold goes up along with it. Since the end of World War II, the five years in which U.S. inflation was at its highest were 1946, 1974, 1975, 1979, and 1980. During those five years, the average real return on stocks, as measured by the Dow, was -12.33%; the average real return on gold was 130.4%.

Today, a number of factors are conspiring to create the perfect inflationary storm: extremely stimulative monetary policy, a major tax cut, a long term decline in the dollar, a spike in oil prices, a mammoth trade deficit, and America's status as the world's biggest debtor nation. Almost across the board, commodity prices are up despite the short-term absence of a weakening dollar which is often viewed as the principal reason for stronger commodity prices.

Oil, Inflation and Gold

Although the prices of gold and oil don't exactly mirror one another, there is no question that oil prices do affect gold prices. If oil prices rise or fall sharply, investors can expect a corresponding reaction in gold prices, often with a lag.

There have been two major upward moves in the price of gold since it was freed to float in 1968. The first occurred between 1972 and 1974 when oil prices climbed 325%, from $2.44 to $10.36. During the same period, gold prices rose 268% (on a quarterly average basis) from $47.45 to $174.76.

The second major price move occurred between 1978 and 1980, when oil prices increased 105%, from $12.70 to $26.00. Over the same period, quarterly average gold prices rose 254% from $178.33 to $631.40.

II. GOLD - HEDGE AGAINST A DECLINING DOLLAR

Gold is bought and sold in U.S. dollars, so any decline in the value of the dollar causes the price of gold to rise. The U.S. dollar is the world's reserve currency - the primary medium for international transactions, the principal store of value for savings, the currency in which the worth of commodities and equities are calculated, and the currency primarily held as reserves by the world's central banks. However, now that it has been stripped of its gold backing, the dollar is nothing more than a fancy piece of paper.

III. GOLD AS A SAFE HAVEN

Despite the fact that the United States is the world's only remaining superpower, there are a myriad of problems festering around the world, any one of which could erupt with little warning. Gold has often been called the "crisis commodity" because it tends to outperform other investments during periods of world tensions. The very same factors that cause other investments to suffer cause the price of gold to rise. A bad economy can sink poorly run banks. Bad banks can sink an entire economy. And, perhaps most importantly to the rest of the world, the integration of the global economy has made it possible for banking and economic failures to destabilize the world economy.

As banking crises occur, the public begins to distrust paper assets and turns to gold for a safe haven.

When all else fails, governments rescue themselves with the printing press, making their currency worth less and gold worth more. Gold has always risen the most when confidence in government is at its lowest.

IV. GOLD - SUPPLY AND DEMAND

First, demand is outpacing supply across the board. Gold production is declining; copper production is declining; the production of lead and other metals is declining. It is very difficult to open new mines when the whole process takes about seven years on average, making it hard to address the supply issue quickly. Gold output in South Africa, the world's largest gold producer, fell to its lowest level since 1931 this past year as the rand's gains prompted Harmony Gold Mining Co. and rivals to close mines despite 16 year highs in the gold price.

Growing Demand - China, India and Gold

India is the largest gold-consuming nation in the world. China, on the other hand, has the fastest-growing economy in modern history. Both India and China are in the process of liberalizing laws relating to the import and sale of gold in ways that will facilitate gold purchases on a mammoth scale.

China is teaching the West something new. Its economy, growing at 9 percent per year, is expected to become the second largest in the world by 2020, behind only the United States. Last year Americans spent $162 billion more on Chinese goods than the Chinese spent on U.S. products. That gap has been growing by more than 25 percent per year. China 's consumer class, meanwhile, is spending on everything from bagels to Bentleys - and will soon outnumber the entire U.S. population. China's explosive growth "could be the dominant event of this century," says Stapleton Roy, former U.S. ambassador to China. "Never before has a country risen as fast as China is doing."

China recently passed legislation that will allow the country's four major commercial banks to sell gold bars to their customers in the near future. Currently, individuals in China are only allowed to buy gold-backed certificates from the Bank of China and the Industrial and Commercial Bank of China.

V. GOLD - STORE OF VALUE

One major reason investors look to gold as an asset class is because it will always maintain an intrinsic value. Gold will not get lost in an accounting scandal or a market collapse. Economist Stephen Harmston of Bannock Consulting had this to say in a 1998 report for the World Gold Council, " ... although the gold price may fluctuate, over the very long run gold has consistently reverted to its historic purchasing power parity against other commodities and intermediate products. Historically, gold has proved to be an effective preserver of wealth. It has also proved to be a safe haven in times of economic and social instability. In a period of a long bull run in equities, with low inflation and relative stability in foreign exchange markets, it is tempting for investors to expect continual high rates of return on investments. It sometimes takes a period of falling stock prices and market turmoil to focus the mind on the fact that it may be important to invest part of one's portfolio in an asset that will, at least, hold its value."

Today is the scenario that the World Gold Council report was referring to in 1998.

VI. GOLD - PORTFOLIO DIVERSIFIER

The most effective way to diversify your portfolio and protect the wealth created in the stock and financial markets is to invest in assets that are negatively correlated with those markets. Gold is the ideal diversifier for a stock portfolio, simply because it is among the most negatively correlated assets to stocks.

Investment advisors recognize that diversification of investments can improve overall portfolio performance. The key to diversification is finding investments that are not closely correlated to one another. Because most stocks are relatively closely correlated and most bonds are relatively closely correlated with each other and with stocks, many investors combine tangible assets such as gold with their stock and bond portfolios in order to reduce risk. Gold and other tangible assets have historically had a very low correlation to stocks and bonds.

Although the price of gold can be volatile in the short-term, gold has maintained its value over the long-term, serving as a hedge against the erosion of the purchasing power of paper money. Gold is an important part of a diversified investment portfolio because its price increases in response to events that erode the value of traditional paper investments like stocks and bonds.

|

Prices

For KARATBARS | Apples to Apples

Prices

For KARATBARS | Apples to Apples